Operator Fleet Procurement Considerations

In our previous short post, we discussed the importance of product market fit and social acceptance as operators procure their eVTOL fleets. Certification and financing are two equally important considerations for operators.

- Product Market Fit – Vehicle selection based on an operator’s unique use case and mission requirements (discussed in the last short post)

- Social Acceptance and Awareness – Public acceptance and its impact on operator business models (discussed in the last short post)

- Timeline on Certification / Entry into Service – OEMs’ ability to bring their vehicles into service

- Financing – Asset financing for operators

Certification

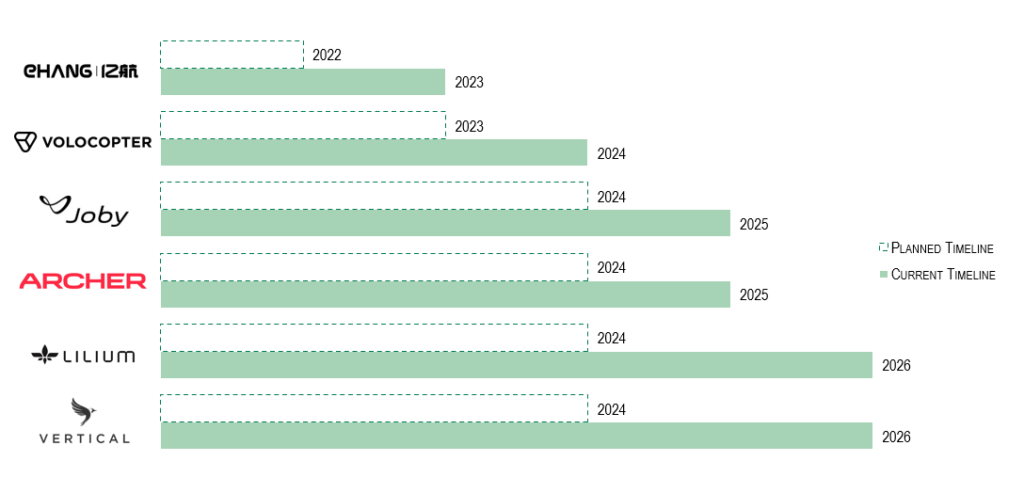

Building new technology is hard. Many eVTOL entry-into-service dates have been delayed, indicating that their forecasted development timelines did not face up to the realities of technological, certification-related, and other potential challenges that are endemic to the design and development of new aircraft.

However, significant progress has been made, with several leading OEMs announcing the achievement of key milestones regarding their vehicles’ certification basis with regulators. In October 2023, eHang received the world’s first eVTOL type certificate from the Civil Aviation Administration of China (CAAC), which bodes well for the industry’s further development and commercialization. Based on revised guidance from other OEMs, the first generation of electric-powered VTOLs is expected to enter service in the middle of this decade.

Exhibit 1. OEM Aircraft Certification Timeline

Source: OEM Public Releases

eVTOLs are a novel category of aircraft – they are neither fixed wing aircraft, nor helicopters, but rather a combination of both, powered by a new set of technologies that are without precedent in aviation. The Distributed Electric Propulsion (DEP) system that eVTOLs leverage is based on the premise that closely integrating the propulsion system with the airframe and distributing multiple motors across the wing will increase efficiency, lower operating costs, and increase safety. Yet, novelty also brings about added scrutiny and a different set of certification challenges– eVTOL certification is not simply an assessment based on a combination of Part 23 and Part 27 aircraft regulations.

Until recently in 2020, no all-electric aircraft had ever been certified. With electric aircraft, there are additional safety factors (e.g., flammability of the batteries) and airworthiness considerations (e.g., newly developed electric propulsion systems).

Differing Certification Standards by Regulatory Authorities

FAA and EASA are currently pursuing different frameworks for the certification basis of eVTOLs.

- EASA – Leverages existing CS-23 (small plane) and CS-27 (rotorcraft) certification, and incorporates special conditions for VTOL aircraft and electric / hybrid propulsion systems

- FAA – Uses special conditions of 21.17(b), supplemented with other FAA regulations as appropriate – this type certification uses the performance-based airworthiness standards tailored to the “powered-lift” aircraft category with the original attempt to certify similar aircraft (AW609) in early 2000s, it is an uncharted territory for the agency and OEMs as no “powered-lift” aircraft has yet been certified, but FAA intends to certify AW609 as a special class aircraft under 21.17(b) before issuing formal powered-lift airworthiness standards for eVTOLs; Special Federal Aviation Regulations were given to temporarily permit vehicle operations before finalizing regulations

These disparities result in varying safety objectives, failure criteria, and runway requirements, among other certification considerations. Certain OEMs aim to obtain certification from both regulatory bodies, while others may choose to focus on obtaining certification from just one. While regulatory certification will likely converge between FAA and EASA over time, it is expected to happen gradually as the regulatory agencies build up flight test data to better assess the efficacy of the current regulations.

Consequently, operators must carefully assess the ways in which their vehicle’s certification process might impact its deployment (or lack thereof) in specific geographic areas.

OEM’s Technical Capabilities for Certification

Operators should carefully monitor their desired vehicle’s certification progress and likelihood. Key considerations for a successful certification process include:

- OEM Certification Experience: Certification is a lengthy and complicated process to navigate, requiring an experienced team to meet the specific requirements from authorities within a targeted timeline .

- Engineering Progress: Bringing a new aircraft design to life involves hard engineering, and given the novelty of the sector, much more flight testing is required to prove and test the technology. OEMs that have a flight test schedule will help mitigate potential unwelcome surprises late in the certification process.

- Manufacturing Capability: Manufacturing capabilities, whether internal to the company (e.g. Joby and Beta opened their manufacturing plant in late 2023) or outsourced to reputable vendors (e.g. Archer cooperates with Stellantis for production) are key to scaling up to meet desired production rates and, eventually, support on-time delivery of vehicles to operators.

OEM’s Financial Capabilities through Certification

A key non-technical consideration is the ability of OEMs to fund their businesses through the certification process and into the revenue-generating commercialization phase. Even traditional aircraft OEMs have faced delays and cost overruns which have strained financial resources. As an example, the Boeing 787 was delayed for four years and faced cost overruns of billions of dollars due to numerous manufacturing issues and customer compensation.

It is increasingly evident that the entry-into-service (EIS) timelines for certain eVTOL programs are challenging, and further delays will require additional working capital to fund operations before the eventual cash inflow generated from vehicle sales.

As of the most recent updates in December 2023, some eVTOL OEMs appear to possess financial reserves to cover their expenses for the coming 1-2 years (e.g., Joby had $1.0 billion in available cash, Archer had >$460 million) while some may need capital injection in the near term to sustain its R&D and SG&A expenses.

An OEM insolvency would severely hamper or cancel the development of a new aircraft. Hence, it is imperative for operators to closely monitor vehicle certification progress, OEM cash-on hand, and cash burn rates.

Cash burn rate and cash on hand indicate whether additional capital or financing is required to support R&D efforts to bring the vehicle through certification. Beyond certification, manufacturing facilities – if not outsourced – will also require significant capital investment that must be factored into financing requirements.

Financing

Today, almost all eVTOL orders have been placed directly by operators, which contrasts with the commercial aviation sector where approximately 50% of the global commercial fleet is leased and many more financed through several types of debt transactions.

Financing helps an operator improve their cash position and strengthens their balance sheet,. However, financiers are generally risk-adverse and may have concerns about earning a return on their investment in an eVTOL OEM or its vehicles; direct bank loan financing to operators are likely to emerge as the market further matures. And finance and operating lease are potential alternatives for operators in the meantime.

Finance Lease

A finance lease allows lessees to operate the vehicle without having to pay the full amount to acquire the asset, despite the remaining financial lease obligations being recorded on the operators’ balance sheet as liabilities. The leases are typically long term (usually for the aircraft’s full life) so that the financiers can recover the upfront vehicle acquisition costs over the life of the asset.

While this structure benefits operators’ cash flow, lessees’ creditworthiness are an important factor in determining the lease rates and collateral requirements.

Finance leases benefit the operator by:

- Acquiring the asset without full payment, as the financiers will purchase the asset and operators can spread the cost over the lease term

- Ownership transfer, at the end of the lease term

- Ability to customize, finance lease terms can often be customized to suit the lessee’s specific needs and financial situation

Operating Lease

An operating lease transfers significantly more asset risk from the operator to the financier. Not only will the lessor be concerned about the operator’s credit profile, the lessor will also be concerned about the vehicle’s marketability as well, and will consider the eVTOL’s residual value, tradability, and useful life, among other concerns.

Operating leases benefit the operator by:

- Improving cashflow and balance sheet conditions, by reducing initial capital outlay and borrowing costs, reducing leverage, and mitigating residual value risks

- Increasing flexibility in operating strategies, by easily up-/down-gauging based on market demand and network strategy, as well as maintaining preferred fleet characteristics such as age

- Mitigating aircraft technology risk given the novel aircraft technology

As the industry evolves, financing of eVTOLs will be beneficial for operators, as it has been for their commercial aviation counterparts. To engage financiers in the eVTOL business, it is crucial that they have a comprehensive understanding of the associated benefits and risks.

Operators play a vital role in assisting financiers in two ways.

- Operator Business Model and Credit Profile. Operators must have clearly defined business models that seek to fulfil market needs. A sustainable business plan will go a long way in convincing financiers of the ability for operators to pay for the vehicle.

- OEM and eVTOL Risk. While this might be the primarily responsibility of the OEM, operators play an important role in demonstrating the product-market fit of the eVTOL, and thereby convincing financiers of the market applicability not only of the particular eVTOL but also of the potential of the entire AAM industry.

Conclusion

Over two short posts, we have identified four key areas that operators should consider when acquiring eVTOLs, including the operator’s product market fit, OEM’s vehicle certification, the market’s social acceptance for eVTOLs, as well as the ability to obtain eVTOLs financing.

It is worth noting that a number of OEMs will try but fail to bring their products to the market, whether due to certification-related issues, financial constraints, or both. Some OEMs may be acquired by better-positioned OEMs to survive as part of a bigger and stronger entity. And there will be those that fail.

Given these dynamics, operators have two key strategies to contemplate:

- Become an early adopter – Engage with OEMs early in the process prior EIS to have a longer runway to understand the requirements and limitations of the vehicle. The early involvement can benefit the operator by facilitating design discussions, and / or influencing ultimate vehicle design, and potentially reaching beneficial pricing. Being an early adopter also signals leadership in the eVTOL sector, particularly at a time when the industry is nascent.

- “Wait and see” – Allow the industry to progress and engage only when the “finalists” in the eVTOL manufacturer space emerge. While the operator may not be a first-mover, it helps to de-risk the operator’s fleet acquisition plan.

As eVTOLs approach their target EIS dates and OEMs focus their efforts on commercializing their vehicles, operators must carefully and strategically consider their approach to this new era of mobility.