eVTOL Orders: 2022 Wrapped

Advanced air mobility, also known as AAM, is a new concept of air transportation. While there are three major types of aircraft – Electric Vertical Takeoff and Landing (eVTOL) vehicles, Electric Short Takeoff and Landing (eSTOL) vehicles and Electric Conventional Takeoff and Landing (eCTOL) vehicles – the eVTOL space has been truly exploding, with significant investments pouring in and orders being placed by future operators.

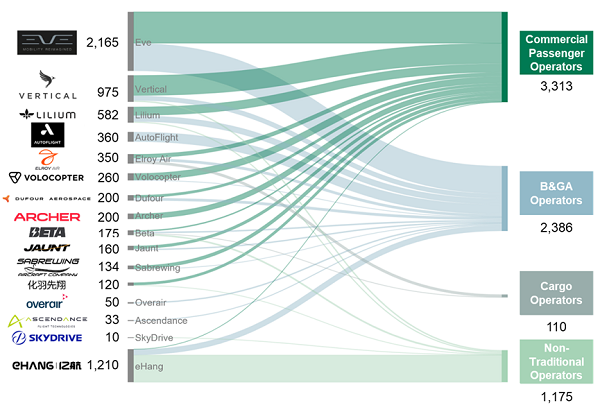

Operators have ordered around 7,000 eVTOLs1 as of December 2022. The mass orders are an indication of the strong optimism for the AAM sector, and the opportunities that portend from the introduction of new aircraft technology. The breakdown of these orders indicates that around 50% of the total have been placed by commercial passenger operators2, while around 30% have been placed by business and general aviation (B&GA) operators.

The balance is split between cargo operators and non-traditional3 players. Take the example of United Therapeutics, the medical group that has established partnerships with eHang and Beta Technologies to develop an ecosystem for future organ transportation.

Exhibit 1. eVTOL Orders Placed by Operators (As of December 2022)

Note: Includes non-firm orders and excludes unidentifiable clients, options, and power-by-hour agreements

Source: SMG Consulting, Lilium, AutoFlight, Alton

Notably, several original equipment manufacturers (OEMs) like Joby Aviation are absent from the chart above as they have plans to operate eVTOLs themselves. Joby in particular has formed partnerships with Delta Air Lines, JetBlue, All Nippon Airways, and Uber to bring urban air mobility services to the market, with some of the partners having committed equity investments (e.g., Delta’s $60M investment in Joby).

Looking at the overall order book, North America domiciled carriers lead the other regions in number of orders.

North America operators have ordered 3x as many AAM vehicles as the operators in the next region and account for around 55% of the total orders. Some notable deals include United Airlines’ order of 400 eVTOLs from Archer and Eve Air Mobility4 and American Airlines’ order of 250 eVTOLs from Vertical Aerospace. 5 While orders represent an important signal of demand, most of them are conditional, non-firm and not requiring any deposits, essentially allowing the operators to walk away from the deals.

That said, this year finally saw some pre-delivery payments (PDPs), with United committing $10M in PDPs for 100 of Archer’s eVTOL in August 2022 and American making a similar PDP commitment in July 2022 for 50 eVTOL from Vertical6. eVolare, a subsidiary of Volare Aviation, one of the UK’s largest helicopter and private jet operators, announced in December that it will pay PDPs to Lilium to secure its orders for up to 20 aircraft7. These commitments are significant milestones to the commercialization of the eVTOL aircraft.

B&GA operators placed 30% (~2,400) of the total eVTOL orders

Operators in this space include business jet operators, helicopter operators, asset-light platforms like Blade Air Mobility and Flapper as well as start-ups that focus on AAM. While some operators have only committed to one type of eVTOL aircraft, others have extended their partnerships to a wider OEM base.

For example, Bristow Group, the leading global vertical flight solutions provider, has its orders spread between OEMs like Beta, Elroy Air, Eve, Lilium, Overair, and Vertical Aerospace. Similarly, Flapper, a Brazil-based asset-light aerial mobility provider, has signed orders and PBH (Power-by-Hour) agreements with Jaunt Air Mobility, Eve, and Electra (an eSTOL aircraft manufacturer).

The rationale behind the diversified order strategy is not difficult to comprehend. Firstly, operators may have in mind a diverse set of applications for AAM, including passenger flights, cargo transportation, medical evacuation and others, and there may not be a single product that can fit all use cases perfectly. Additionally, there is an overall realization that only a limited number of OEMs will eventually succeed. If an operator aims to be the leader in eVTOL operation, putting all of its eggs in one basket may not be the ideal strategy when it comes to placing a bet on the emerging sector.

Despite a relatively smaller order book from cargo carriers, major ones have all made a commitment to the eVTOL space through different forms of partnerships.

Among major cargo carriers, UPS has a deal with Beta Technologies for up to 150 eVTOLs8, while FedEx partnered with Elroy Air to develop and test an autonomous eVTOL for cargo transportation by 2023. A similar partnership was also formed between SF Express and Pipistrel in 2021, and the Chinese logistics giant estimates that it will need more than 1,000 eVTOL aircraft in the next 10 years.

Other notable developments in cargo space include Amazon’s investment in Beta Technologies in 2021, with a goal to optimize efficiency in last-mile delivery and promote sustainability, followed by a second investment in 2022. While the order book may be relatively small compared to other segments, cargo players are putting increasing emphasis on eVTOL usage. The fast growth of e-commerce and the need to improve efficiency in middle and last mile delivery indicate that eVTOL will be playing an increasingly important role in this segment.

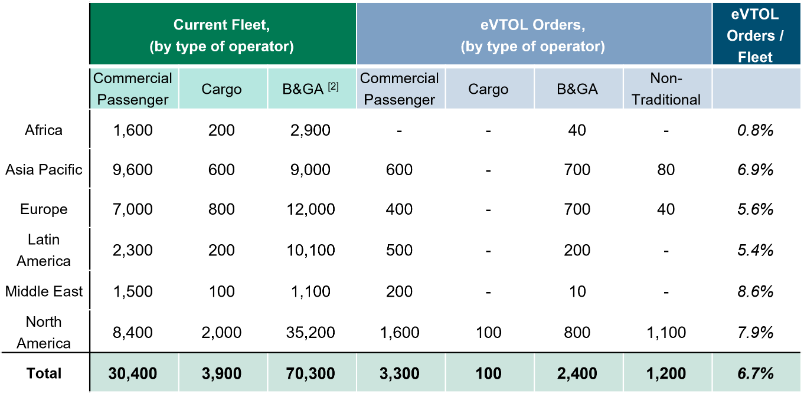

Putting eVTOL orders in the context of the overall aircraft fleet, globally eVTOL orders represent ~7.0% of the current commercial aviation and B&GA fleet.

With the exception of Africa, all other regions have ordered approximately 5 – 9% of that region’s aviation fleet. Eventually, many eVTOL OEMs are expecting the sector to be a volume game, more akin to automotive manufacturing than aerospace manufacturing. Some forecasts suggest eVTOL fleets significantly outpacing the “traditional” aircraft fleet, with some estimates suggesting over 76,000 eVTOLs in operation by 2040 in the US alone9.

Exhibit 2. Global distribution of fleet types as of December 20221

Note: [1] Figures rounded to the nearest 100s, includes inactive and in service fleet; [2] Includes helicopters, turboprops, and business jets

Source: CAPA, JetNet, SMG Consulting, Lilium, AutoFlight, Alton

Outlook

In 2023, we expect to see the continuation of some of the trends observed in 2022, with new OEMs entering the market, existing OEMs intensifying their operator outreach activities, and more operators seriously considering eVTOL in their business strategies and willing to partner with the manufacturers. 2023 would also take some of the OEMs a step closer to delivering or being forced to postpone ambitious certification targets planned for 2024-2025. We will continue watching this exciting space.

Notes

- All order information is sourced from OEM press releases. Excluding options, unidentified orders, and PBH agreements

- Defined as scheduled airlines, lessors, etc

- Includes but not limited to medical companies, ferry operators, etc.

- Fortune, 8 September 2022

- American Airlines, 10 June 2021

- Reuters, 15 July 2022, 11 October 2022

- Lilium, 5 December 2022

- UPS, 8 April 2021

- Morgan Stanley, 6 May 2021