AAM Entry-Into-Service Considerations – Airport Shuttle Service

As advanced air mobility (AAM) nears initial commercialization in the middle of this decade, we take a look at the initial entry-into-service considerations at one of the promising early use cases for AAM – the airport shuttle service.

We breakdown the stakeholder considerations into four main areas:

- Use case rationale – Establishing the airport shuttle use case as a key launch market segments

- Infrastructure preparedness – Ability for cities and airports to accommodate eVTOL aircraft

- Operator considerations – Factors to consider as eVTOL operations launch in key markets

- Economic considerations – Price competitiveness with current airport transportation options

Key Launch Market Segments

During initial phases of commercialization, the first generation eVTOLs coming to market will be primarily focused on airport transfers; this approach by operators is sensible for several reasons:

- In the early stage, the eVTOL industry will have higher vehicle acquisition and operating costs relative to the mature stage; as a result, revenue generated from initial eVTOL use cases must be able to support these elevated costs

- Customers at the premium end of the commercial aviation market typically place a higher value on their time and have a higher willingness to pay for discretionary services, and thus are more likely to bear the higher per-seat cost for eVTOL flights in the industry’s early stages

- Airport transfers via helicopter or luxury car are well established in several US cities (particularly New York City), and there is existing demand for this type of service

- The airport transfer use case has payload-range capabilities that lie within the operating envelope of the initial eVTOLs coming to market using today’s battery technologies

- Central to the value proposition of the airport transfer use case is time savings. Most airport transfer eVTOL flights will require the passenger to embark on an initial ground leg (via public transportation, taxi, uber, on foot, etc.) to arrive at the vertiport from which the eVTOL departs. Depending on the length of time this leg takes, there is a risk that the time savings of the eVTOL flight is eroded by the initial ground leg, rendering the eVTOL value proposition less attractive than the traditional airport transfer modes. As a result, eVTOL operators must ensure that vertiports are conveniently located to preserve the time-saving value proposition of their flights.

- Furthermore, many current helicopter airport transfers deliver their passengers “landside” to the airport, meaning that passengers must then proceed through the passenger terminal and clear security. One would hope that eVTOL operators would eventually be able to deliver their passengers “airside” to the airport (i.e. they have cleared security at their origin point) and can allow passengers to then proceed directly to their flights. This concept of operations (ConOps, an outline of how a system, project, or operation will be carried out and how it is expected to function) would require additional security infrastructure in place at the origin vertiport.

- As the industry matures and scales, it is expected that the cost of manufacturing, operating, and maintaining these aircraft will fall, thus increasing the total addressable market of use cases and end users; other compelling passenger-oriented use cases for eVTOLs include, among others:

- Urban air mobility (e.g., high frequency, short range missions within urban environments)

- Regional flights (<500mi flights to ex-urban locations or between cities)

- Tourism (e.g., helicopter tours in Hawaii)

- Air ambulance

- Search and rescue / humanitarian missions

- Other law enforcement missions

Infrastructure Preparedness in the Urban Air Taxi Market

Both the ground infrastructure and air infrastructure needs to be established to allow eVTOLs to fly to and from airports.

- Certain existing heliports, fixed base operators (“FBOs”), and airports are likely to be able to install the required charging infrastructure to facilitate all-electric eVTOL operations, particularly in launch markets.

- It is highly unlikely, however, that vertiport infrastructure will be at sufficient scale to facilitate widespread eVTOL operations (i.e. outside of initial launch use cases / routes) at the early stage of maturation.

- In terms of ground infrastructure, many cities that will eventually serve as eVTOL launch markets do have conventional helicopter infrastructure in place (e.g., helipads). However, there will need to be significant investment in charging infrastructure to facilitate eVTOL operations at these existing facilities. This may require upgrades of electric grids at airports and cities.

- Furthermore, construction of new vertiports – some with the ability to facilitate operations involving several vehicles at once — will be required to facilitate “urban air mobility” at the scale envisaged by the OEMs and operators.

- Many creative ideas for the siting and construction of vertiports have been raised, including the conversion of parking structure roofs into vertiports; while innovative, these “conversion” projects will still require significant financial investment, particularly for projects involving the construction of vertiports on raised services / roofs.

- Vertiports must be equipped with several features, including (but not limited to):

- Situated in locations that can conveniently capture demand from its surrounding area.

- Offer sufficient passenger services (e.g., security, check-in, etc.).

- In terms of “air infrastructure”, regulators are defining blueprints for airspace integration, but the full ConOps between ground, air, and vehicle needs to be developed and rigorously tested before EIS.

- Enhancements will be required to existing airspace management in order to accommodate the entry of thousands of additional aircraft into the national air space, particularly since initial use cases will involve flying in and around Class B airspace (controlled airspace surrounding the country’s busiest airports).

- While VFR-type operations will be okay for shorter range operations in good weather conditions / daytime flying, the ability to fly IFR will be required in order for the industry to achieve the scale envisaged by the OEMs. The ability to fly IFR will require both payload-range enhancements to the vehicles (to be able to provide the sufficient reserve power required by IFR) as well as to airspace management infrastructure.

- In order for the business case to work, eVTOLs will need to operate at high frequency (on a cycles basis); accommodating these high frequency operations in both congested urban cores as well as busy international airports will require investment in updated airspace management infrastructure, training for air traffic controllers, and development of ConOps for this new paradigm of air travel.

- It is believed that the introduction of autonomy (both on the ground and in the air) will enable more seamless, numerous, and more frequent operation of eVTOLs in the future.

Operator Considerations During Initial Launch Phase

Outside of the already-discussed infrastructure-related considerations, there are several other potential issues that operators must consider and / or address, including:

- Time savings value proposition: in exchange for paying the premium for an eVTOL flight vs. traditional mode of transport to / from the airport, passengers must be able to achieve promised time savings; this requires placement of origin vertiports in desirable and convenient locations with strong demand

- Baggage allowance: Operators must have a plan in place for accommodating passengers / families with several pieces of luggage. Currently, Blade (operator of airport transfers via helicopter in New York City) limits passengers to 25lbs, with any baggage in excess of that limit needing to be transported via ground shuttle at an additional charge. The latter situation negates the ESG aspect of the eVTOL offering

- Pilot availability: Most eVTOLs are expected to operate under FAA Part 135, which requires pilots to have a commercial pilot certificate and 500 hours of flight experience under VFR and 1,200 hours under IFR operations; there is currently an imminent pilot shortage in the aviation industry, compounded for eVTOL operators by the fact that eVTOL pilots will need to obtain a certification for “powered lift” aircraft (even if they hold an existing fixed wing / helicopter certificate) and will also need individual type certifications for each type of eVTOL they fly. Operators will need to have a plan in place for sufficiently “staffing up” ahead of the launch of their services

- Community concerns: Significant efforts will need to be made by OEMs and operators to educate communities on the benefits of eVTOL aircraft (e.g., enhanced mobility, safety, lower noise profile, etc.). Even a perfectly executed eVTOL launch and commercialization strategy can be derailed by operational restrictions imposed by municipalities or other public sector entities.

Economics Considerations – Building a Sustainable Profitable Business Model

There are key cost and time savings considerations to consider when comparing eVTOLs to conventional modes of transportation.

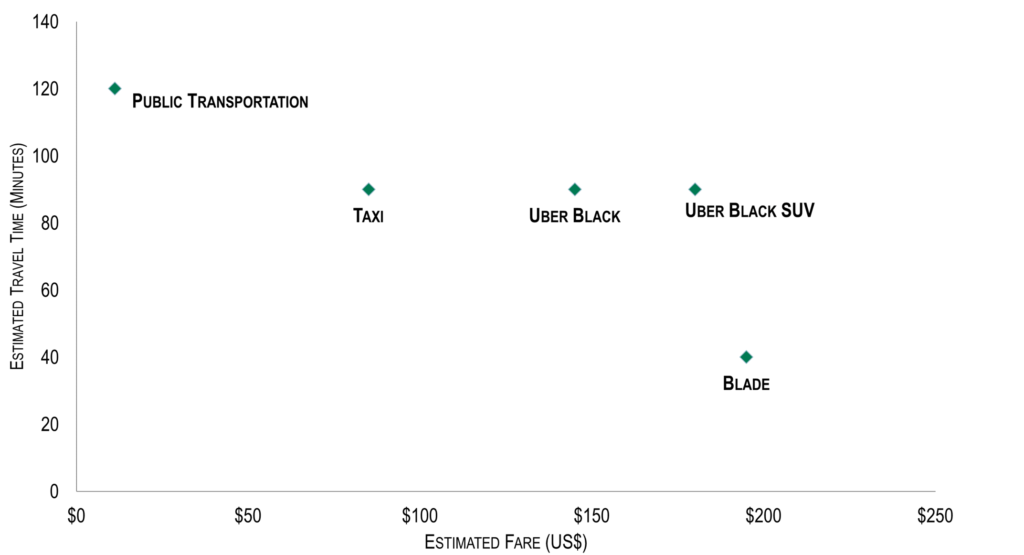

- Taking a journey from Midtown Manhattan to JFK in New York City as an example, the costs and trip time for various existing transportation modes are as follows:

Exhibit 1. Travel Time vs. Fare Comparison from Midtown New York to JFK Airport

Note:

Blade helicopter: Fare includes 25lbs of baggage; total time includes 10-15 minutes car journey to the heliport, 5 minutes wait time at the heliport, and 10 minutes drive after landing at the private terminal to the public terminal

Taxi: Fares can vary based on traffic and point of origin

Public transportation: Fare comprises of subway fare of $2.90 + AirTrain fare of $8.25

Blade and public transportation fares are per person, while Uber and Taxi fares are per trip

- The cost vs. time savings dynamic is real; a customer typically accustomed to Uber Black or Uber Black SUV pays between $145 and $180, but for an additional premium of $15 to $50, can potentially reduce the transit time by up to 1 hour.

- eVTOLs promise to deliver significant cost advantages over helicopters (when operated at scale) due to lower maintenance requirements, simpler motors with fewer moving parts, and the ability to use electricity rather than jet fuel

- As a result, assuming eVTOLs will deliver comparable time savings on the Manhattan-JFK route vs. helicopters, and can be operated with lower costs relative to helicopters, then they should certainly be competitive for customers who typically opt for Uber Black or Blade, and the OEMs hope that one day they will be competitive even for customers who opt for transportation options at the lower end of the market (e.g., UberX and taxis)

Looking Forward

The impending commercialization of AAM brings forth a focused examination of the initial considerations for airport shuttle services. Key aspects encompass the strategic positioning of the airport shuttle as a primary launch market segment, the imperative for infrastructure readiness, operator considerations navigating regulatory and operational challenges, and the critical economic viability against existing transportation options.

These comprehensive considerations underscore the strategic and multifaceted approach required for the successful integration of AAM, marking a significant step toward transforming the landscape of urban transportation.