New Value Propositions

Operators have broad ambitions for eVTOLs and are particularly excited by the potential of these new-generation vehicles to revolutionize air transport by lowering costs and / or by opening up new revenue streams. With the increased focus on climate change, the ability of eVTOLs to have zero emissions is also an increasingly important consideration.

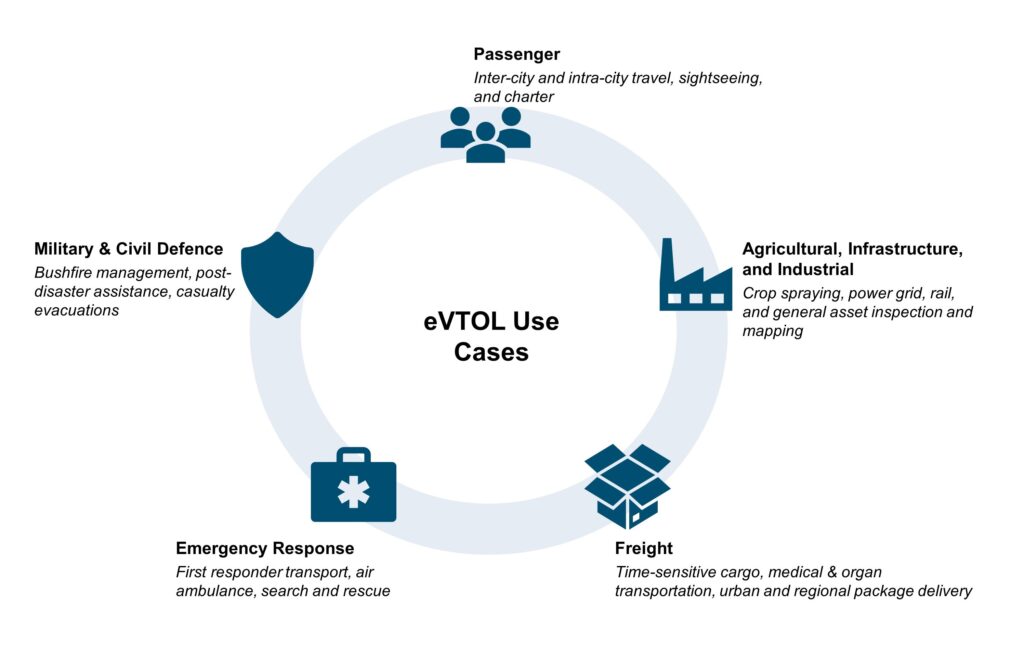

Urban air mobility (including air taxis) has been the most talked about use case for eVTOLs, but the opportunities are much wider. eVTOLs can transform passenger transportation by replacing or complementing traditional modes of air, ground, or marine transportation. The fast growth of e-commerce and the need to improve efficiency in middle and last mile delivery suggest that eVTOLs could play an increasingly important role in freight transportation. Furthermore, eVTOLs may also be replacements for other civil, para-public, or military applications.

Exhibit 1. eVTOL Selected Use Cases

Source: Alton

Technical Advantages of eVTOLs

Not be a single eVTOL product can serve all these use cases perfectly. Some eVTOLs have very short ranges, making them more applicable to inter-city travel, while some others are targeting cargo markets, for example. However, there are a few common key characteristics of the eVTOLs’ value proposition.

Operating Cost

To demonstrate the cost advantage of an eVTOL, the industry often compares it to a helicopter given design similarity underpinned by vertical takeoff and landing capability. In fact, many of the eVTOL orders have been placed by helicopter operators, eyeing the cost savings that eVTOLs can bring to their operations.

The cost saving estimates of eVTOLs vary across a wide range but are indicated to have the potential to be significant. For example, Jaunt Air Mobility indicates that their eVTOL will cost ~45% less to operate than helicopters like the Bell 505, while according to American Institute of Aeronautics and Astronautics, a typical eVTOL design (similar to Joby) is expected to have ~38% lower variable operating costs compared to the Robinson R44.

Some eVTOL players suggest benchmarking eVTOL trip costs to an Uber Black trip cost. This may resonate better with the public as helicopter passenger transportation remains relatively exclusive today. Reducing operating costs by 25%-45% may not be enough to fully “uberize” future trips – the costs may still be too high for the general public, and full-scale eVTOL adoption would require a more radical reduction in operating costs.

Noise

A study conducted by Airbus indicates that after operational safety, noise is the second key criterion for eVTOL public acceptance.

Cities are concerned about noise pollution, as it affects residents’ quality of life. Helicopter operations have been restricted in many cities due to the noise they generate. OEMs are striving to blend the noise into the environment or reduce the eVTOL’s noise signature through the use of noise reduction technologies.

Joby has conducted a number of acoustic tests where initial results show significant noise improvement compared to helicopters. Joby recorded 45dBa noise (equivalent to a refrigerator humming or moderate rainfall) at a cruising altitude of 1,640 feet above the ground and ~65dBa noise (equivalent to a normal conversation or a bustling business office) at takeoff (300 feet above the ground). These noise emissions are about 6x lower compared to those generated by traditional 5-6 seat twin-engine helicopters (73dBa at 492 feet above the ground).

When it comes to noise, it is critical to address external and internal noise alike. As customers expect eVTOLs to have a similar noise footprint as cars, the internal noise level is also expected to be at least similar to a commercial aircraft powered by internal combustion engines. OEMs are also working on internal structural designs to offer customers a quiet journey.

Vertical Take-off / Landing

The ability to take off and land vertically enables eVTOLs to operate from virtually any location (e.g., remote accident sites) and to access space-constrained areas (e.g., dense city centers). This capability, however, comes at a cost. Battery technology today is far from mature and the vertical takeoff and landing flight phases are very energy consuming. Depending on the eVTOL design, hover requires 7-10 times more power than forward flight and sacrifices range and payload.

With this major drawback, operators that do not necessarily require aircraft to take off and land vertically favor designs that can take off and land on a conventional runway, thus extending the range of the aircraft. In June 2022, Lilium revealed a key change to its design by adding traditional landing gear to enable short runway landing capability (albeit not takeoff). The additional range and traditional landing capability can also help in the certification process, as it addresses conditions where vertical landing is not an option.

Trip Time

eVTOL has a significant advantage over ground vehicles in urban air transportation as they can bypass traffic congestion in increasingly crowded and gridlocked metro areas. This ability to alleviate traffic congestion by opening up new urban air transport routes could reduce the need for more costly urban road infrastructure programs, saving time, money, and inconvenience to the metro area population. In addition, compared to traditional processes at airports/ airplanes, eVTOL operations can reduce waiting times and increase productive time.

In emergency response applications, the shorter time required for pre-takeoff procedures compared to helicopters including eliminating the need for engine warm up ensures a faster response time and can help save lives.

Sustainability

In terms of emissions, eVTOL can provide a positive impact on the transportation industry based on its lower emission compared to conventional transportation that is powered by fossil fuels. According to Lilium, it expects an eVTOL will generate 95% fewer emissions on a per passenger kilometer basis travelled, when compared to typical private aviation operation.

However, with the limited scale of eVTOLs’ anticipated deployment and the expected short sectors flown, the technology is unlikely to be a massive game changer in the aviation industry’s overall environmental record. Nevertheless, with increasing awareness and support by the public in pursuing such initiatives, there may be enough influence to further broaden these green technologies towards other areas of the aviation industry in the longer term.

Range and Payload

Range and payload are the key limiting factors in the near term due to battery technology barriers.

Joby’s and Lilium’s eVTOLs have ranges of 150 and 155 mile range respectively, while Beta’s all-electric Alia has the longest range of 250 miles (in conventional takeoff and landing configuration). Beta’s eVTOL aside, the target range is sufficient for airport taxi services and cities within close proximity but is unlikely to support operations between major metropolitans like Boston and New York.

This technological barrier will likely persist for a period of time. According to Vertical Aerospace, battery cell energy density improved from 220Wh/kg in 2015 to 290Wh/kg in 2022, a roughly 10Wh/kg progression per year. And Lilium projects ~350Wh/kg is needed for the target 155-mile range. For eVTOLs to fly a longer distance of ~250 miles, at least 500Wh/kg will be required. This target is not impossible but will take years or even decades to achieve.

To overcome this shortage, hybrid-electric can be a viable alternative. Several OEMs including Honda, Ascendance and XTI are developing this type of VTOL aircraft, while Jaunt Air Mobility has partnered with a major hybrid-electric propulsion specialist VerdeGo Aero to develop such an alternative. All of these aircraft are expected to have a longer range compared to all-electric battery-powered aircraft.

Another alternative solution is to power the aircraft with hydrogen, yet the development is still at the early stage with very few OEMs concentrating on this technology. The majority of efforts are still focused on retrofitting traditional aircraft with hydrogen technology.

From Theory to Practice – eVTOL Use Cases

Focusing on the passenger transportation segment, the advantages offered by eVTOLs open significant opportunities for existing operators.

Replacing the Existing Fleet with a More Cost-Efficient Solution

For some operators, the first step in the eVTOL transition journey could be a replacement of existing fleets with more cost-efficient and environmentally friendly options. For example, as a first use case, some operators are considering using eVTOL on sightseeing routes in place of helicopters or seaplanes. Additionally, hybrid-electric eVTOL with longer range could replace light business jets on regional routes.

Expansion into First / Last Mile Transportation Services

Air travel has traditionally been focused on the airport to airport journey. For the most part, passengers had to procure their own first/last mile transportation separately to get to and from an airport.

With eVTOLs, airlines could expand their share of the customer’s travel journey beyond airports, thereby retaining a larger share of the travel wallet. eVTOLs offer airlines the opportunity to enter an adjacent market segment and provide a better travel experience for their passengers. Bigger airports with a higher volume of travelers are likely to incorporate eVTOL connections first and to develop AAM corridors to prove this use case. And with the progressing range capability, passengers can further enjoy the convenience of direct links between major cities like New York and Washington DC, without the hassle to commute through airports.

A similar concept also applies to B&GA operators. Customers can significantly cut their transit time and improve their experience by hopping on an eVTOL to get to and from their larger jets to their end destinations.

Opening New Routes

eVTOLs will allow airlines to expand their current route maps to serve destinations that are impractical to serve with larger planes. Moreover, eVTOLs have the potential to enable more direct routings from origin to destination, bypassing connecting hubs. Without the restriction of airports, airlines can effectively expand their natural catchment area and their networks, therefore increasing demand for services.

Tapping Into New Business Models

Unscheduled air services have traditionally been reserved for those with the means to afford such travel – these customers have the flexibility to reserve a private aircraft at any time and their destination of choice.

With the introduction of eVTOLs, competition in the unscheduled air shuttle services market will increase due to the emergence of new operator types aiming to serve the “democratized” market. Lower ticket prices will open air travel to more customer segments, potentially enabling operators with a different business model and customer value proposition to serve the market. As the industry matures, eVTOLs are expected to lead the ride-sharing model for on-demand air transportation services, similar to that of Uber for ground transportation.

Existing B&GA operators such as NetJets and Blade have announced orders for eVTOLs, and will be the incumbents in this segment with the market knowledge and operational setup to serve the market. New entrants from other transportation segments, such as ride-hailing service providers like Grab, could also be expected to join the race as they develop multi-modal propositions.

Looking Forward

In 2024, we expect to see more pilot programs to further prove the feasibility of the stated use cases. It will be a year that many OEMs start to test their flights and progress in the certification process. Despite the macro-economic headwinds, operators are expected to continue exploring how eVTOLs will fit into their business model, as the aircraft has many merits that traditional airplanes do not possess.

Note: All technical information is sourced from OEM press releases.